Free Day Trading Classes by Day Trade FEED

Free day trading classes are now available for everyone!

With summer here, planning vacations and little getaways has become pretty common. Unfortunately, with that planning comes the anxiety and insecurity that only financial uncertainty bring. Look, we’ve all been there. And it’s no secret that we all wish we had a little bit of extra income to give us the financial breathing room to actually enjoy these trips. Well, look no further. Starting now, Day Trade FEED is offering free Day Trading Classes!

Whether you’re a day trader who has been day trading for the past ten years, or simply wanting to find out about some different options to help you out financially, this is the opportunity you’ve been waiting for.

For more information on these free day trading classes, contact us or register for a free, no-strings-attached day trading webinar.

We understand if you’re a little unsure, but rest assured our proprietary indicators and tried-and-tested education program can and will make you successful.

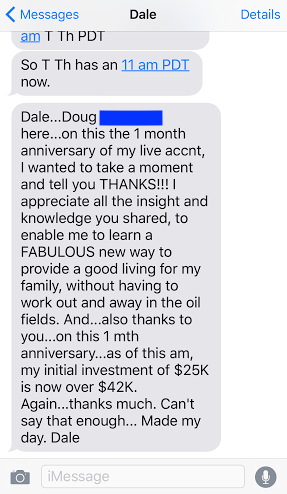

If you’re STILL not convinced these free day trading classes are effective, here is a little proof…

Free Day Trading Classes can be confusing, so Day Trade FEED wants to help you understand the Day Trade My Money Program!

We’re absolutely positive you’ll see what you like at these free day trading classes, and we’re even willing to put money on your success!

One of the main offerings you’ll learn about at Day Trade FEED’s free day trading classes is the new Day Trade My Money Program. Basically, we trust this system so much that anyone who is willing to learn it, live it and love it enough to give it the effort required will be eligible to have an account funded by their corporate office… and yes, you read that correct.

They will GIVE YOU MONEY TO TRADE.

Many people ask themselves why a company would do this instead of just trading their own accounts to make profit?

“Every trader hits a limit where the risk is more than they are willing to take on individually. If we traded accounts totaling millions, taking a loss could be very significant.

However, if we let others trade our money, it is more protected. Some are buying, some are selling. Some are in the Euro, others in the Pound. Some taking a loss, others winning. Overall, diversifying our investment funds brings in better returns than typical investment vehicles.”

Interested yet? Contact us!

What do these free day trading classes teach?

The answer is simple: free day trading classes teach you day trading 101.

While most traders we deal with decide to trade the EUR USD forex market, we do see the occasional trader decide to jump right in and trade futures markets. The reason many traders decide initially to trade forex is because the market in general is slower moving, meaning more time to make decisions and a smaller chance at taking losses.

…BUT the beauty of these free day trading classes by Day Trade FEED is that they focus on the individual! We recognize that no two traders are the same, in fact, we love the diversity! That’s why when a trader tells us they want to trade futures markets, we don’t even bat an eye.

Want to learn more? Subscribe below: